How do I setup VAT in the UK?

Setting up VAT is really easy with Sellr, you can simply set a VAT rate and choose whether that rate is inclusive or exclusive of the products price, or you can choose to add different tax rates for different items. See below to get started...

How do I get started with UK VAT rates?

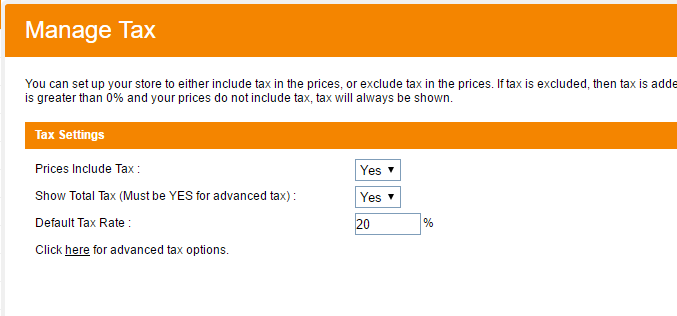

In the drop down menu at the top of the page click 'Configure' > 'Tax' and set your default VAT rate. You can choose whether your prices include VAT or not.

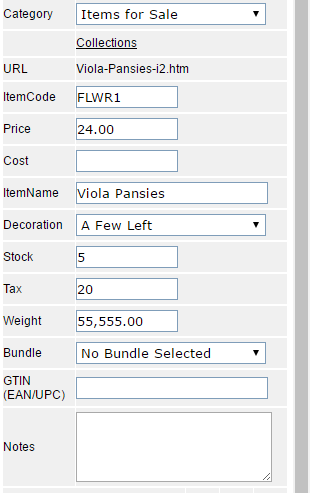

You can also set the VAT per product by editing a product and putting the VAT percentage in the tax field.

Using Advanced Tax

You may need to set a different VAT rate for different products. You would use tax bands to do this.

- To set up tax bands click 'Configure > 'Tax' and then click the 'here', hyperlink for advanced tax options.

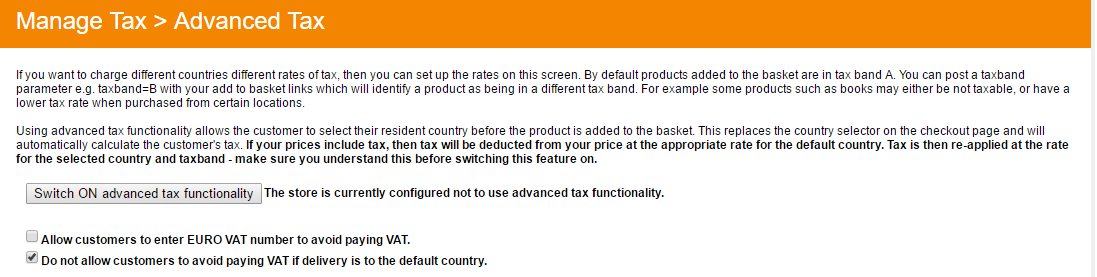

- Click the 'Switch ON advanced tax functionality' button to switch on advanced tax.

![]()

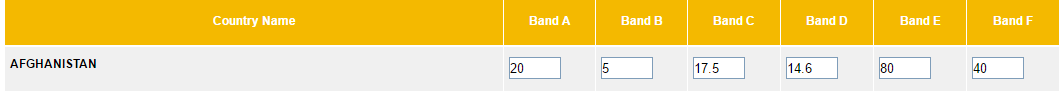

- Enter different VAT rates within the different bands. You will be applying the tax band to different products, so if you have a product that has a VAT rate of 5% then enter that into Band B

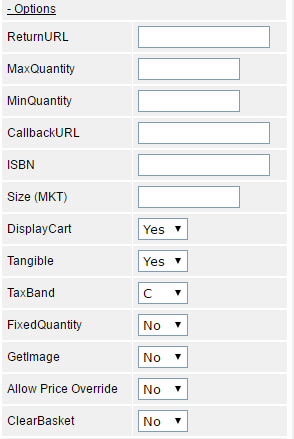

- Now edit your product and click on the 'options' link to apply a tax band.